What Church Leaders, Architects, Wardens and Surveyors Must Know to Plan & Fund Conservation Projects

Updated for 2026 – with the latest guidance on VAT, budget caps, new capital funds and practical implications for your church’s repairs.

For more than two decades, historic churches and other listed places of worship across the UK have relied on the Listed Places of Worship Grant Scheme (LPWGS) to reclaim VAT paid on eligible repair, maintenance and restoration work. This mechanism was not a full VAT exemption but a government-funded rebate programme that helped ensure essential conservation work could proceed without imposing excessive tax burdens on local congregations and communities.

In 2025 and 2026, however, this fiscal support framework underwent its most substantial transformation since its introduction, with implications for budgeting, project planning and long-term stewardship of heritage buildings. For those responsible for delivering repairs — including church professionals, architects, surveyors and wardens — understanding these changes is now essential.

The Listed Places of Worship Grant Scheme was designed to refund the VAT charged on eligible repair and maintenance work to listed worship buildings. It applied across faiths and building types — including churches, chapels, meeting houses, temples, mosques and synagogues — provided the structure was listed and principally used for public worship.

Key Points Historically

For many years, the rebate significantly reduced the financial burden of maintaining ageing heritage buildings, where VAT at the standard 20% rate would otherwise add a high extra cost to already stretched budgets.

However, the structure and scale of support have changed recently.

Caps and Budget Constraints

From 1 April 2025, two fundamental changes were introduced for the final year of the scheme’s operation:

Where the VAT costs exceeded £25,000 in a year, churches still had to cover the extra 20% from their own funds. This significantly affects larger conservation projects, from tower and roof repairs to major structural and fabric works.

Practical Impact on Projects

These cap and budget changes mean that architects and surveyors working on major programmes must plan not only the phasing of works but also the timing of claims to make the most of the remaining scheme before it closes.

In January 2026, the UK Government confirmed that the LPWGS would close permanently on 31 March 2026, or earlier if the annual budget runs out.

A new government funding package is replacing the scheme:

The “Places of Worship Renewal Fund”

Crucial Distinctions

🏛️ No direct VAT rebate: Churches will now be responsible for paying the 20% VAT on eligible works upfront — and cannot reclaim this from the Renewal Fund.

📑 Grant application required: Funding will be competitive, and project prioritisation will be managed through assessments rather than simple receipt of refunds.

This represents a fundamental shift from a reimbursement model based on VAT incurred to a strategic capital fund focused on channelled investment.

For Architects and Surveyors

For Church Wardens and PCCs

For Church Professionals

To make the most of the LPWGS while it still exists:

✅ Review current project pipelines:

Split large works into phases over financial years to spread VAT reclaim potential up to the £25,000 cap.

✅ Submit claims early:

The remaining LPWGS funding may run out before the statutory deadline if claims exceed the annual £23 million budget. (Listed Places of Worship Grant Scheme)

✅ Check eligibility:

Only listed places of worship used primarily for public worship can claim. Ensure project costs are allowable before submission.

Example:

If your church has £200,000 of eligible works starting in early 2026, you could claim £25,000 of VAT refund before 31 March 2026 — but must pay the remaining £15,000 of VAT as irrecoverable tax unless a separate relief applies.

Church bodies, heritage trusts and sector advocates have been active in response to these changes. Emerging concerns include:

Despite the change, church leaders — including the Church of England — have welcomed the investment while stressing the need for support with transitional challenges.

Issue | Before April 2026 | After April 2026 |

VAT Refund | Up to £25,000 cap per year | No direct rebate |

VAT Liability | Covered up to the cap | 20% paid and retained |

Funding Mechanism | Receipt-based claims | Competitive capital grants |

Administration | Online claim submission | Formal grant applications |

Budget Certainty | First-come, first-served | Panel decision by Historic England |

The changes to VAT treatment and the listed places of worship funding regime represent one of the most significant shifts in how church repairs are financed in decades. Professionals involved in heritage repairs must now think beyond straightforward VAT recovery, integrating strategic budgeting, phasing, grant writing and stakeholder communication into conservation planning.

While the LPWGS has been a valuable source of support, its sunset and replacement by the Places of Worship Renewal Fund underline the need for forward-looking, evidence-based project planning. Early action — especially before March 2026 — can help churches transition to this new reality with minimal disruption.

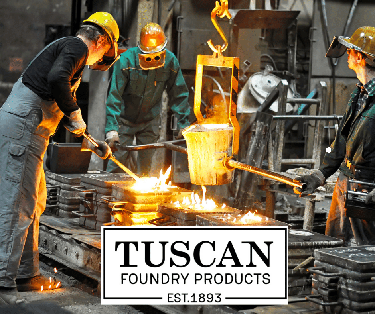

At Tuscan Foundry Products, we’ve proudly partnered with churches and heritage professionals across the UK for over 130 years, supplying traditional cast-iron rainwater goods and ventilation solutions tailored for listed ecclesiastical buildings. Our products combine historical authenticity with modern performance — ideal for Grade I and II churches undergoing sensitive restoration.From bespoke cast iron hoppers to heritage-style roof glazing, we support surveyors, architects, and church wardens in safeguarding sacred spaces for future generations. Discover more about our church restoration products here.